The Party Continues

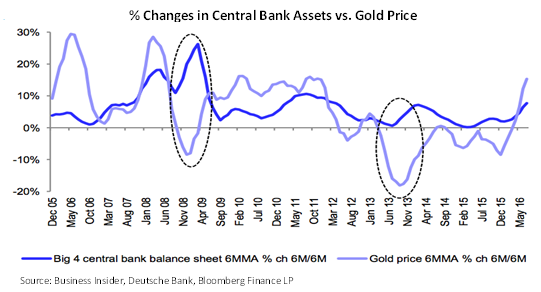

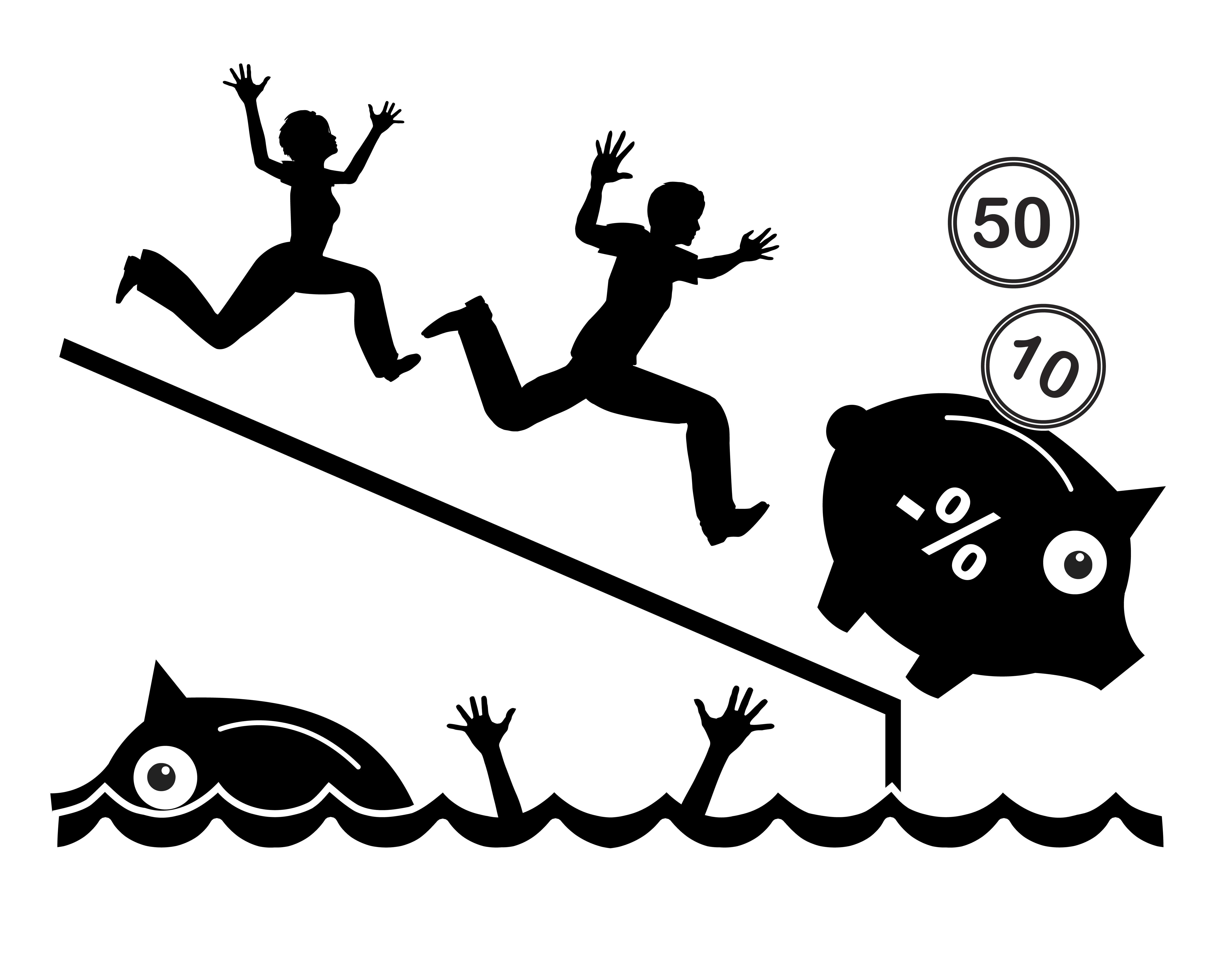

The highly anticipated September FOMC meeting has now come and gone. The Fed elected to hold rates steady by a vote of 7-3. Although this vote may have been closer than many had expected, perhaps more important than the vote itself was the central bank’s economic outlook and commentary. The Fed’s so-called “dot-plot” is pointing to a very gradual pace of rate hikes, with the Fed Funds target rate also being lowered from a three percent target to a 2.9 percent target. It is now... Continue Reading

Category | Economic and Geopolitical News