3 Reasons Now is a Golden Opportunity to Buy Gold

Have you ever purchased something on sale? Have you ever purchased something because you felt you were getting it for cheaper than it was actually worth? If you have ever made such a purchase you may be an investor that understands value. Unfortunately, many retail investors make decisions based on fear and emotion instead of value. They sell when they should buy and they buy when they should sell. Humans are inherently followers. Chasing the herd can get you in trouble.

With rampant inflation, the war in Ukraine, and a hawkish Fed, would you consider this a good time to buy gold?

If you answered yes, you understand the fundamentals of value and are correct. Intelligent retirement investors are making the move to gold in IRAs and 401(k)s.

Here are three reasons to buy gold now:

The Price Of Gold

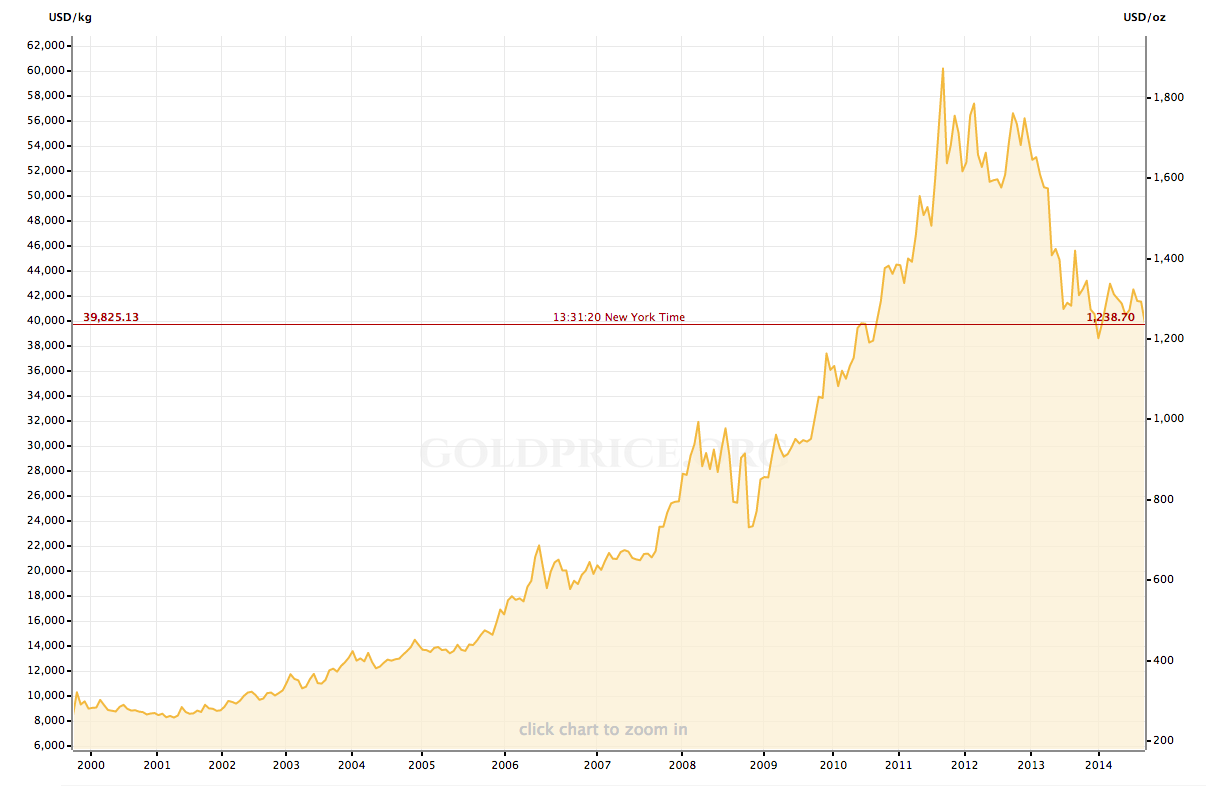

For some mining companies, the gold price is below margin cost for production for large portions of their supply. Long-term investors should be very aware of the fundamental opportunity to buy gold at this time. One should never fail to purchase an asset below its replacement value. If you are focused on properly allocating in your IRA or 401(k), now is a sensible time to purchase gold because of its price respective to cost of incremental production. The investment makes sense for retirement and non-retirement investors alike.

When gold prices increased, the cost of production also increased. As we explained in our most recent blog post, mining companies scrambled to ramp up production to keep up with demand. With current gold prices around $1870, unless gold goes up or new technology comes along to make the process cheaper, production will decrease. Many mining companies’ incremental cost of production is above $1,300 and the average is believed to be $1,200. Basic supply and demand fundamentals signal that this is a good time to buy gold in your investment account, IRA or 401(k). There is no fundamental likelihood for a decrease in demand and the cost of production will likely rise. As a result, prices should rise.

Diversify With Gold

It is widely believed that investors should have at least some of their portfolio in gold. Each investor has their own risk profile and investment goals but a minimal 5-10% is common. You may be saving for retirement in an IRA. You may be allocating investments in your 401(k). You could also be looking to diversify your taxable investment account. In general, investors are poorly diversified and their strategies are outdated. Many investors can attribute past investment losses to undiversified allocations and neglecting their portfolios. Don’t make the same mistakes. Stay up to date and make appropriate changes when necessary. Gold helps dampen volatility and increases stability and security for investors. Diversification is the only way to secure your portfolio and gold is a major component of a properly diversified portfolio.

Gold Has Inherent Value

Now is the time to go looking for value in gold. In times of turmoil, physical gold can serve as a safe haven for investors, especially in IRAs and 401(k)s. Physical gold can rally on geopolitical uncertainty from an international incident, an unexpected flare-up of inflation or negative financial occurrence. With both of those happening right now, it’d be foolish not to consider a strong allocation in gold. Though the dollar remains strong, international currencies continue to see fluctuation. Unlike many commodities that hinge on economic activity drivers, gold is often moved by political turmoil. We can all agree that there is no shortage of political turmoil in the world right now and there is no sign that will change any time soon.

Gold continues to serve long-term investors positively. Though prices of gold have dropped over the past year, they are reaching attractive levels for value driven, long term and retirement investors. Individuals allocating their retirement IRAs and 401(k)s are consistently finding safety in gold. For many investors, this is an attractive time to make the change to gold.

To learn more about investing in gold during this opportunistic period call Advantage Gold today at 1-800-341-8584. Our group of experienced experts will help you understand the current market and you can also request your free Gold Investor Guide.

Talk to an IRA advisor about how to roll over your 401(k) into a Gold IRA by opening a self-directed IRA account, contact us or call us at 800-341-8584 today.