Another Vote Against Negative Interest Rates

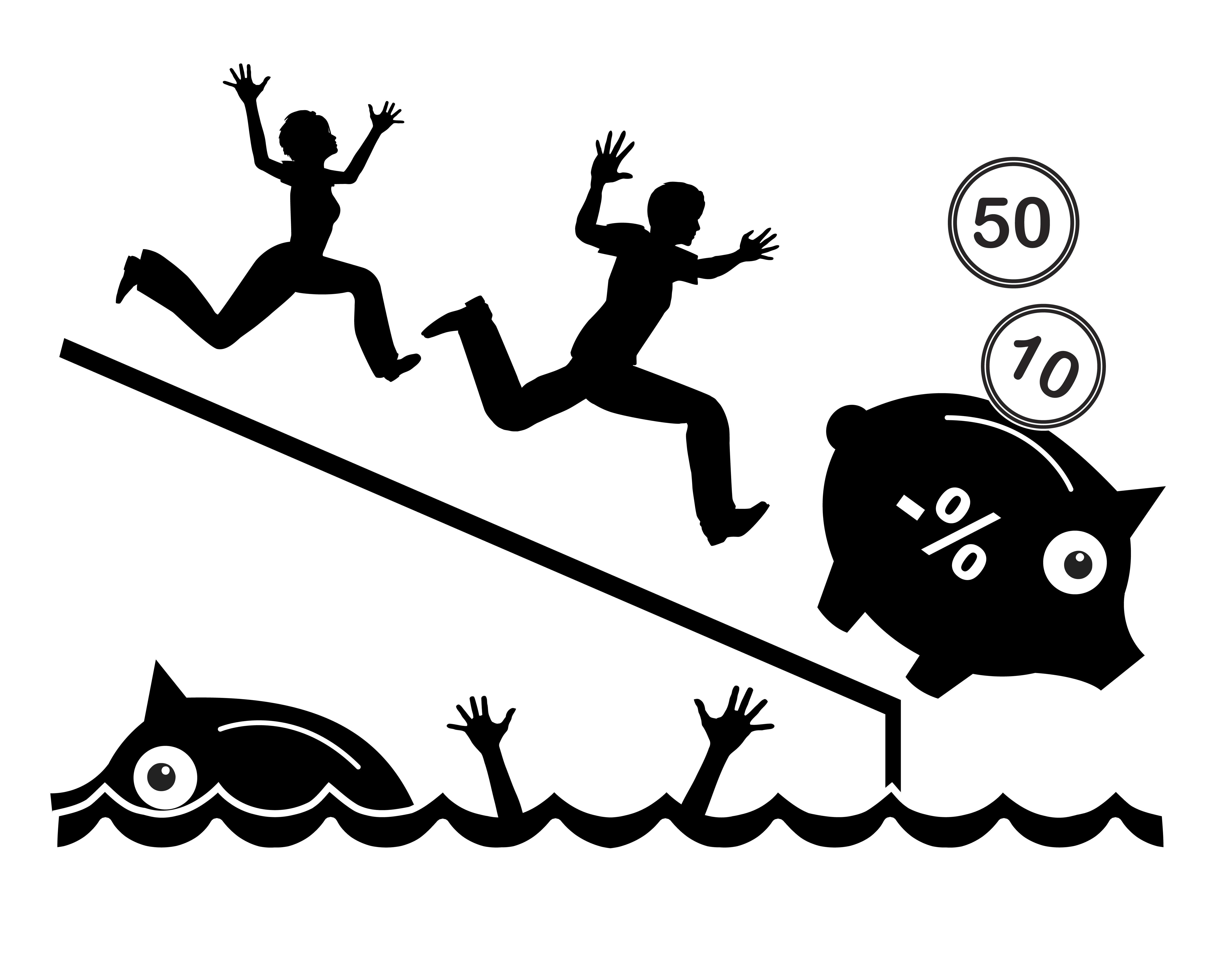

As the spread of negative interest rates is set to continue, German bank boss John Cryan is voicing his thoughts on the monetary policy tool. Cryan is the CEO of Deutsche Bank, Germany’s largest bank and a bank that is recognized all over the globe. As more financial experts weigh in on the potential effects of negative interest rates, Cryan made his opinion fairly clear, stating that such a policy could have “fatal consequences.” Deutsche Bank has felt the effects of negative interest rates which... Continue Reading

Category | Economic and Geopolitical News