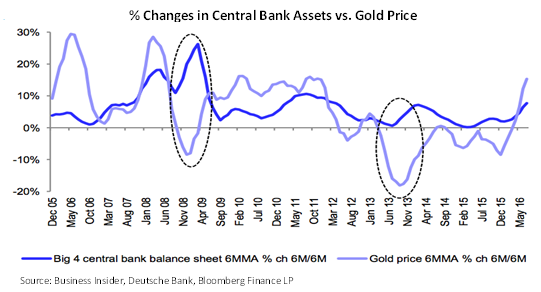

Could Crude Oil Be The Next Major Bullish Catalyst For Gold?

The decline in crude oil prices this past year was the subject of many financial media headlines and stories. After trading as low as the mid-thirties per barrel last winter, the oil market has come back, but not without some ups and downs. With several of the world’s largest oil producers possibly getting ready to implement a production freeze or even a production cut, black gold could potentially see further upside from current levels. In fact, the oil market could potentially rise substantially from current... Continue Reading

Category | Economic and Geopolitical News